Biểu đồ: Tác động lạm phát từ mức thuế 10%, với tổn thất thu nhập thực khoảng $223/chia theo hộ gia đình. (Nguồn: Yale Budget Lab via Seeking Alpha)

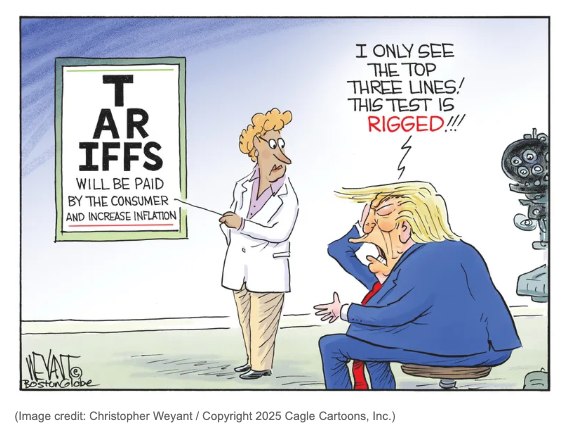

Tariffs can be strategic tools. Thoughtfully applied, they bolster vital industries and deter unfair trade. But today’s sweeping and unstable tariff regime inflicts the harshest damage on the backbone of America—its working class.

1. Bills That Bite—Not Build

-

The Yale Budget Lab estimates that current tariffs will raise consumer prices by 1.8%–2.9%, translating into a $1,900–$4,700 annual loss per household, depending on substitution responses by consumers. Facebook+13CT Insider+13The Budget Lab at Yale+13Yale Daily News+11The Budget Lab at Yale+11Benzinga+11

-

For low‑income families, this burden is proportionally steeper—losing 4% of disposable income, compared to just 1.6% for high‑income households. MarketWatch

These are regressive consumption taxes, taxing essentials like food, clothing, and even everyday electronics.

2. Economic Growth Derailed

Tariffs are projected to:

-

Lower annual GDP growth by 0.5–0.9 percentage points, equating to annual $100–$180 billion in lost output.MarketWatchNYC Comptroller’s Office+9The Budget Lab at Yale+9MarketWatch+9The Budget Lab at Yale+3The Budget Lab at Yale+3Barron’s+3

-

Reduce payroll employment by approximately 500,000, and raise unemployment by ~0.4 percentage point by end of 2025. Seeking Alpha+14The Budget Lab at Yale+14The Budget Lab at Yale+14

While manufacturing sees a modest uptick (2–2.5%), sectors like construction and agriculture lose ground, illustrating that protection for one industry often costs another.

3. Wage Losses Outstrip Gains

Research consistently shows tariffs cost Americans more than they benefit. The Clinton-era steel tariffs led to net job losses of ~200,000, as steel-using industries contracted. The Budget Lab at Yale+2The Budget Lab at Yale+2YouTube+11Wikipedia+11Wikipedia+11

One study found Trump-era tariffs may have reduced real GDP by 0.04% and cost U.S. consumers and firms $51 billion.Wikipedia+1

The CBO affirmed tariffs would dampen GDP and reduce real household income by ~$1,277 (2019 dollars).MarketWatch+5Wikipedia+5Barron’s+5

4. Tax Cut for the Rich, Tax Hike for the Poor

The narrative that tariffs “protect jobs” fails to account for context:

-

Many Americans benefited from corporate tax cuts, while the costs imposed by tariffs are soaked up by everyday households.

-

Tariffs disproportionately bite the wallet of working and middle-class families, often offsetting gains from wage growth or employment.

Economists and watchdogs label claims of massive tariff-generated revenue—like the $6 trillion figure—implausible, noting that estimates realistically hover around $2.3–$2.5 trillion over a decade. documentcloud.org+12The Washington Post+12Facebook+12Yale Law School

Conclusion: The Real Trade War Is at the Cash Register

In a fragile post-pandemic economy, hungry for stability, tariffs may offer short-term political gains—but they come at the direct expense of struggling workers. They raise prices, slow growth, cost jobs—and all too often, these burdens are offset by tax breaks for the affluent.

Policymakers must pivot:

-

Target strategic industries with smart, conditional support,

-

Invest in workforce training,

-

Stabilize global supply chains,

-

Refrain from wielding tariffs as default fiscal policy.

If not, the trade-offs will continue—and ordinary Americans will keep paying, literally, for political theater.